LatAm Investor

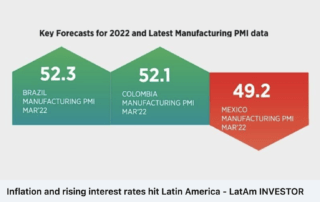

LatAm Investor Inflation and rising interest rates are set to dampen the region’s economic recovery, writes Pollyanna De Lima, Economics Associate Director Economic Indices, S&P Global… In line with the global picture, the economic outlook for Latin America has weakened since the last issue as prevailing headwinds were exacerbated by the Russia-Ukraine war. Rising interest rates, acute price pressures, income squeezes, turbulence in capital flows and COVID-19 loom large as key risks to growth. Official statistics data showed that output returned to pre-pandemic levels in Brazil and Colombia, but Mexico is yet to post a full recovery. Timely PMI (Purchasing Managers’ Index) data indicated that Brazil’s manufacturing sector recovered in March from the pandemic- related downturns seen around the turn of the year, with growth gathering pace in Colombia. Economic conditions remained challenging in Mexico, however, as goods production fell at a faster pace at the end of the first quarter. In January’s update of the World Economic Outlook, the IMF downgraded the 2022 GDP forecasts for Brazil (from +1.5% to +0.3%) and Mexico (from +4.0% to +2.8%), owing to the new wave of COVID-19, the reintroduction of restrictions, energy price volatility and lingering problems in supply chains. Further downward revisions are expected in the April update as the impacts of Russia’s invasion of Ukraine are accounted for alongside strong monetary [...]